(Registration No. 199301008024 (262761-A))

Kuala Lumpur, 26 April 2022

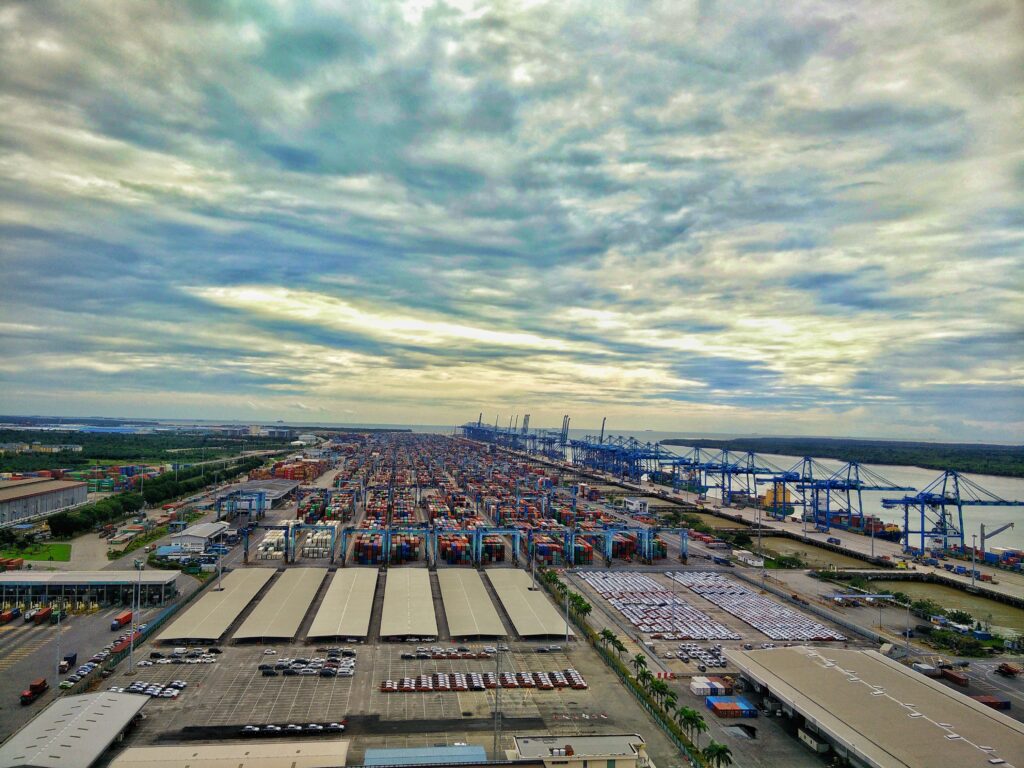

Westports Holdings Berhad (“Westports” or the “Company”) has announced its financial results for the 2nd Quarter of 2022, and the 6-month ended on 30 June 2022. At the top line, the Company reported a total revenue achievement of RM1.03 billion. The Company’s container segment handled a throughput volume of 4.88 million TEUs as Westports accommodated a total of 3,820 vessels.

The period under review witnessed tumultuous global macroeconomic conditions, including the surge in global energy prices, widespread escalating inflationary pressures, interest rates increase, slipping economic momentum, and a military conflict in Ukraine. These adverse challenges are being compounded on top of the unresolved supply chain constraints and pandemic-induced port closures at various points in time in the Far East.

The intensifying headwinds contributed to a reduction in the transhipment containers handled to 2.97 million TEUs. However, the local economy demonstrated better resilience, with overall gateway volume remaining near-identical at 1.91 million TEUs. In the conventional segment, the Company moved 5.46 million metric tonnes of cargo.

The previous year’s terminal congestion issue has been resolved. In 2022, yard occupancy eases without local and significant regional lockdowns — these restrictions hampered efficient container movements. Westports invested and increased the total container ground slots to 52,455 and reefer sockets to 4,132 by the end of 2021.

At the conventional segment, the new Liquid Bulk Terminal 5 (“LBT5”) jetty accommodated its first Very Large Gas Carriers (“VLGC”) in the period under review. Subsequent to that, the first commercial Liquefied Petroleum Gas (“LPG”) throughput was discharged into the recently built facilities. The stored LPG at Pulau Indah would cater to regional customers’ requirements. As the shift towards cleaner energy input gathers momentum, Westports accommodated the biggest Swiss-based container liner’s first LNG Dual-Fuel ULCV (“Ultra Large Container Vessel”) as the latter made its maiden call at Westports in April 2022.

On the Company’s profitability, Westports achieved a Profit Before Tax of RM469 million for the first 6-month of 2022. The lower interim profit reflected the absence of the non-recurrent insurance recoveries and the surge in fuel cost by 84%; Westports purchases diesel at an unsubsidized price. At the bottom line, Westports reported a Profit After Tax of RM314 million, which was lower by 19% as the Company incorporated the one-year prosperity tax in 2022. Hence, the Company’s effective tax rate is 33% for the first 6-month period of 2022.

Westports has implemented a dividend payout ratio of 75% on its Profit After Tax since its public listing in 2013. The only exception was in 2020, when the ratio was temporarily reduced to 60% due to prudent Covid-19 precautionary measures. Based on the period under review’s interim Profit After Tax and payout ratio of 75%, Westports has announced its first interim ordinary dividend of 6.91 sen, which amounted to RM236 million. The first interim dividend is to be paid on 23 August 2022.

Datuk Ruben Emir Gnanalingam bin Abdullah (“Datuk Ruben”), the Group Managing Director of Westports, shared that “In addition to the weakening economic momentums, volatile financial markets and challenging supply chain timeliness, all of which inevitably and eventually could affect container throughput, the world also has to contend with the challenge of limiting climate change. At Westports, we are committed to achieving net-zero carbon emissions by 2050. The Company will focus and rely primarily on emissions intensity reduction and gradual decarbonization of its fleet of terminal operating equipment. Recently, Westports took delivery of the country’s first Kalmar Eco Reachstacker – the new equipment will start paving the way toward reducing our environmental intensity footprint. During the period under review, Westports’ first solar energy project also commenced. 319 sets of solar panels have been installed on Tan Sri G Culture Hall’s roof”.

Datuk Ruben evaluated and opined, “External developments have become more challenging as the quarters in 2022 progress. The slew of unfavourable macro headwinds, supply chain constraints and pandemic nuances may pose challenges to further broad economic recoveries and trade. For Westports, the fast-evolving external backdrop makes it increasingly more challenging to maintain an identical container throughput volume in the current year. However, the local economy is currently relatively less affected. Therefore, Westports will continue to play its role as the leading gateway port for Malaysia and support her economic activities”.